how to calculate tax on uber income

Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. Can Uber drivers deduct 20 of their income.

Uber Tax Forms What You Need To File Shared Economy Tax

There are various ways to register for GST including completing an online application via the IRD website.

. Standard IRS Mileage Deduction. You can log into your Uber profile and input your. That gets put in.

Tax deductions are recorded expenses that reduce the amount of taxable income that you pay dues on. Just add the income from both rideshare companies together and include the total on one schedule. UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income.

To use this method multiply your total business miles by the IRS Standard Mileage Rate for. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Income tax is not.

Yes most Uber drivers should be able to use the Section 199A deduction to deduct up to 20 of their business income. Instantly get your Uber driving tax calculations based on your Uber mileage. Uber drivers are considered self-employed or independent contractors so the Canada Revenue Agency CRA requires that they file income tax each year.

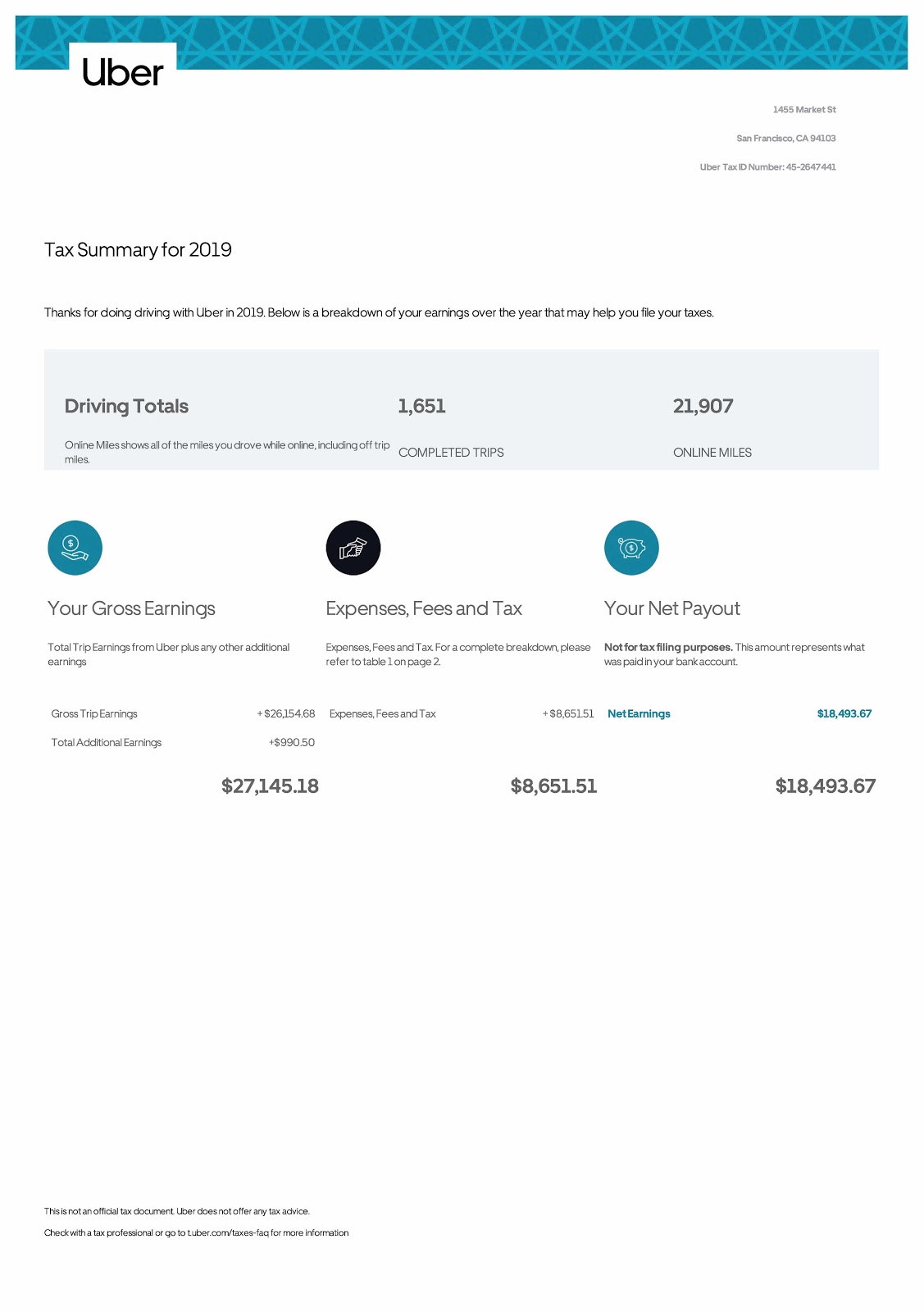

Uber partner-driver tax calculator. I printed my Uber Tax Summary and it shows the following. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed.

Our calculator does all the hard work for you by. This calculator is created to help uber drivers. 101 rows This Is How Much You Spent in Depreciation Wear Tear and Other Expenses.

This number reflects the IRSs 56 cents per mile minus your fuels costs. If your annual income is over 37000 then the tax rate is 325 and you can get 675 1-325455625. How does driving for Uber compare to a minimum-wage job.

This is the easiest method and can result in a higher deduction. Weve made it as easy as possible for you to find out how much youll make when driving. Greetings all For all of you out there baffled about how to calculate your Uber income I have put together this excel spreadsheet which you may find useful.

Your annual Tax Summary should be available around mid-July. Im not a tax expert or a professional CPA. The tax summary available from.

The ATOs Uber tax implications are straight-forward at a basic level. Once you know your taxable income after subtracting the adjustments and deductions you can proceed to calculate the tax owed. If you are responsible to collect sales tax based on this threshold you will need to provide Uber Eats your HSTGST registration number.

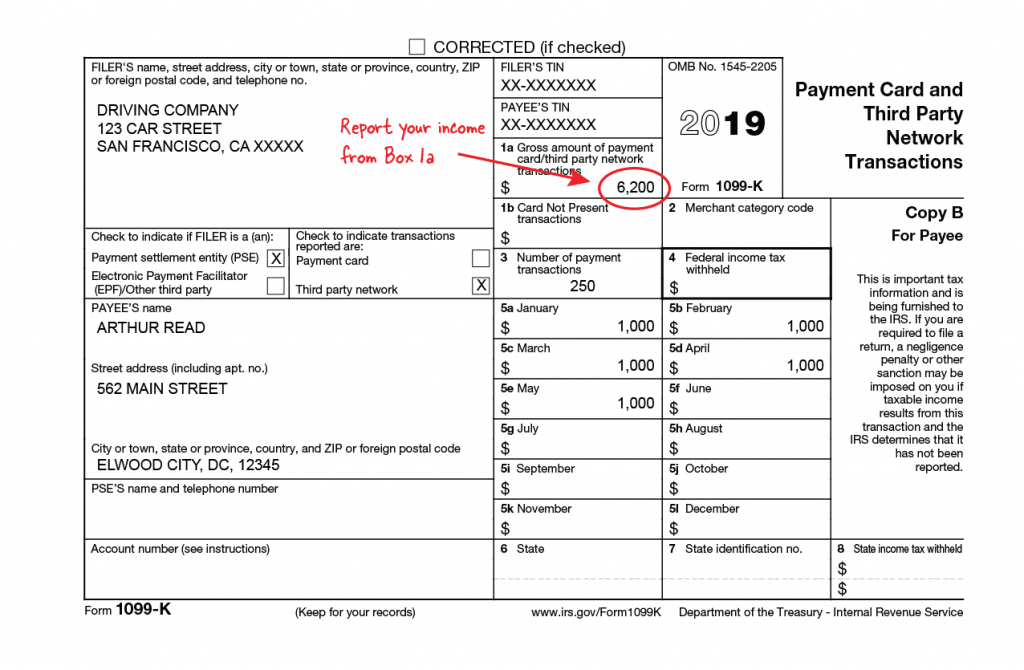

Gross uber rides far 42054 Tolls 571 Booking fee 5750 Total income of 48375 ReferralIncentives 35565. You start out by adding up your income such as from your Uber Eats 1099s or tax summary. This is just a simple calculator to see an estimate of your taxes with standard deductions.

Can I write off my car if. Note you will require an IRD number in order to register for. Deduct your rideshare expenses.

With our tool you can estimate your Uber or Lyft driver taxes by week month quarter or year by configuring the calculator below based on how much and how often you plan to drive. Uber and Lyft Driver Income Estimator. Heres how it works if youre manually filling out your tax forms.

I think for most drivers who have other job should be over 37000. Any money you make driving for Uber counts as income meaning you must declare it on your Tax return. Even if you earn.

Consider these common Uber driver deductions. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. You can find tax information on your Uber profilewell provide you with a monthly and annual Tax Summary.

In the best-case scenario an Uber driver will make on average 2045333 more annually when compared with a.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Wise Ways To Spend Your Tax Refund Stimulus Check Or Any Extra Money Money Management Best Money Saving Tips Budgeting

Paying Taxes In 2021 As Doordash Driver Paying Taxes Doordash Saving Money Budget

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Over The Past Few Months I Ve Seen A Lot Of Misinformation Being Passed Around In Regards To Rideshare Taxes I Definite Rideshare Rideshare Driver Tax Guide

Taxes For The Gig Economy Uber Drivers And More Tax Economy Gigs

The Uber Lyft Driver S Guide To Taxes Bench Accounting

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Door Dash Spreadsheet Track Your Costs Tracking Mileage Mileage Tracker Spreadsheet

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

The Uber Tax Haven Mnc Salary Structure The Best Salary Package On The Planet 100 Tax Free Income Available For Al Tax Haven Investing Books Closing Words

Uber Bas Explained The Ultimate Guide To Bas S For Uber Rideshare

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

Uber Vat Compliance For French Partner Drivers

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Uber Tax Calculator

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Drivers How To Calculate Your Taxes Using Turbotax Turbotax Uber Driver Tax Write Offs

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Tax Deductions Business Tax Deductions Deduction

H R Block 2014 Taxes For Uber And Lyft Drivers Tax Guide Lyft Driver Lyft